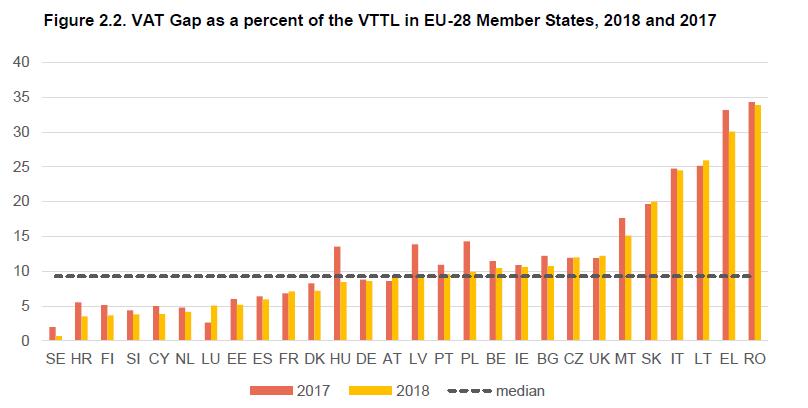

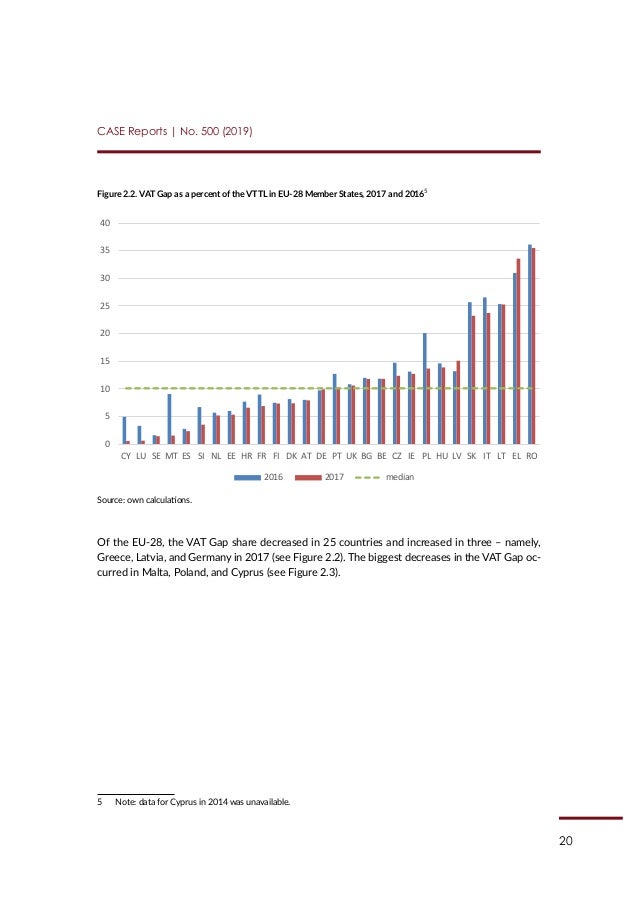

Study and Reports on the VAT Gap in the EU-28 Member States - CASE - Center for Social and Economic Research

Time-varying VAT gap and persistent VAT gap in the western group of EU... | Download Scientific Diagram

Study to quantify and analyse the VAT Gap in the EU-27 Member States - CASE - Center for Social and Economic Research

The Revenue Administration—Gap Analysis Program: Model and Methodology for Value-Added Tax Gap Estimation

PLOS ONE: Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach

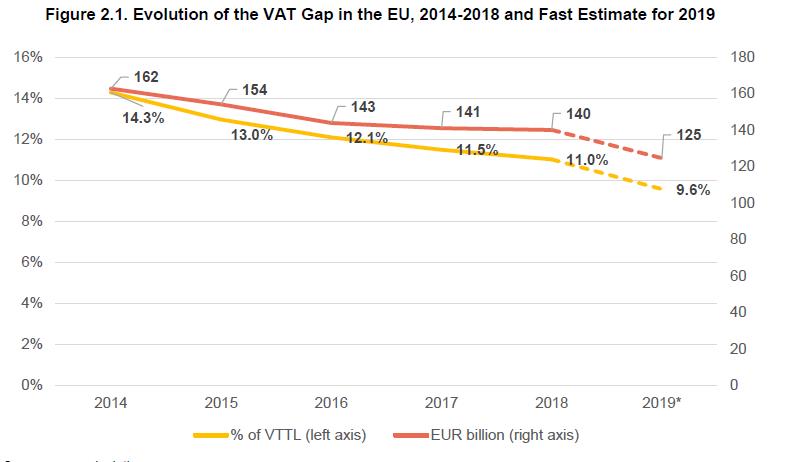

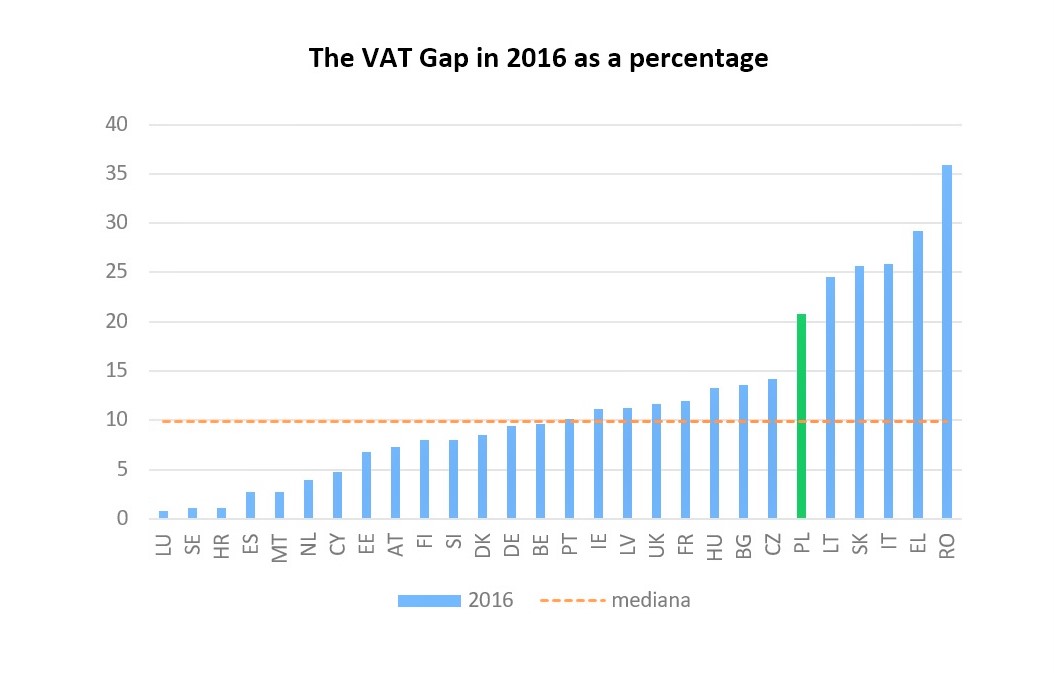

EUR 147.1 billion in VAT revenues was lost in 2016 in the EU - CASE - Center for Social and Economic Research

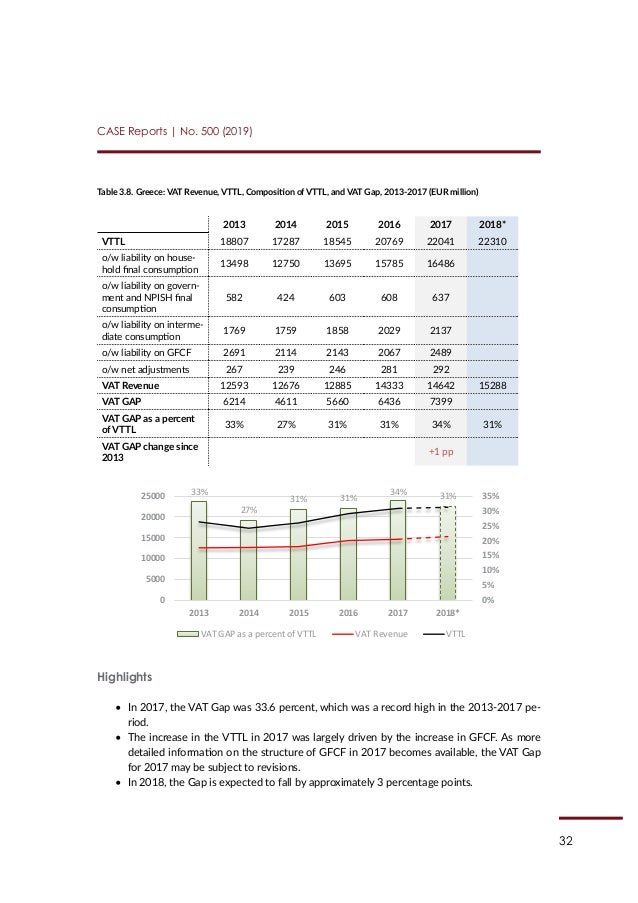

Study and Reports on the VAT Gap in the EU-28 Member States: 2019 Final Report - CASE - Center for Social and Economic Research